Blog

Be Aware of Tax Implications Upon Job Loss

Unemployment has been holding steady recently at 3.7%. But there are still some people losing their jobs — particularly in certain industries including technology and media. If you’re laid off or terminated from employment, taxes are likely the last thing on your mind. However, there are tax implications due to

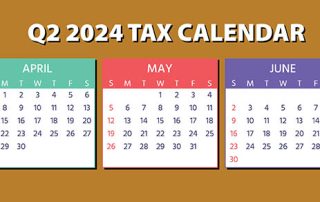

Q2 2024 Key Tax Deadlines for Businesses and Employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to

Defer a Current Tax Bill With a Like-Kind Exchange

If you’re interested in selling commercial or investment real estate that has appreciated significantly, one way to defer a tax bill on the gain is with a Section 1031 “like-kind” exchange. With this transaction, you exchange the property rather than sell it. Although the real estate market has been tough recently

Options For Unused Funds In a 529 College Savings Plan

With the high cost of college, many parents begin saving with 529 plans when their children are babies. Contributions to these plans aren’t tax deductible, but they grow tax deferred. Earnings used to pay qualified education expenses can be withdrawn tax-free. However, earnings used for other purposes may be subject

Lower Your Tax Bill With an IRA Contribution

If you’re gathering documents to file your 2023 tax return and you’re concerned that your tax bill may be higher than you’d like, there might still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until the April

April 15 is the Deadline for Gift Tax Returns Too

Did you make large gifts to your children, grandchildren or others last year? If so, it’s important to determine if you’re required to file a 2023 gift tax return. In some cases, it might be beneficial to file one — even if it’s not required. Who must file? The annual

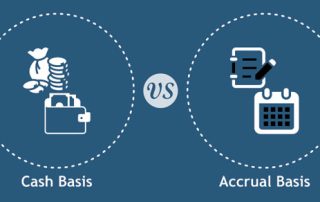

What’s the difference between cash and accrual basis accounting?

Financial statements are critical to monitoring your business’s financial health. In addition to helping management make informed business decisions, year-end and interim financial statements may be required by lenders, investors and franchisors. Here’s an overview of two common accounting methods, along with the pros and cons of each method. Cash

DWC’s Online Tax Planning Guide

Did you know DWC CPAs and Advisors has an online Tax Planning Guide that provides resources and information for tax planning basics, investing, real estate, business and executive comp, family and education, charitable giving, retirement and estate planning. Visit our Client Resources page to access the guide.

Pay Attention to Securities Laws When Planning Your Estate

Do your assets include unregistered securities, such as restricted stocks or interests in hedge funds or private equity funds? If so, it’s important to consider the securities laws that may be involved in various estate planning strategies. Potential Estate Planning Issues Transfers of unregistered securities, either as outright gifts or

Best Practices for M&A Due Diligence

Engaging in a merger or acquisition (M&A) can help your business grow, but it also can be risky. Buyers must understand the strengths and weaknesses of their intended partners or acquisition targets before entering the transactions. A robust due diligence process does more than assess the reasonableness of the sales price. It