SafeSend Returns

Electronic Tax Return Delivery

DWC CPAs and Advisors is pleased to offer electronic tax return delivery through SafeSend Returns. SafeSend provides our clients with a simple, easy-to-use process for securely reviewing and e-signing their tax documents. Benefits include:

- Use SafeSend from the convenience of your computer, smartphone, or tablet.

- Electronically sign, save, and print your tax documents.

- Have a live link to your tax documents for up to three years.

- Electronically access your payment vouchers and receive email reminders of payments due.

- Forward your tax documents to bankers and other professional advisors through a secure email link.

- Enhanced security of your tax return and private information with streamlined automated technology.

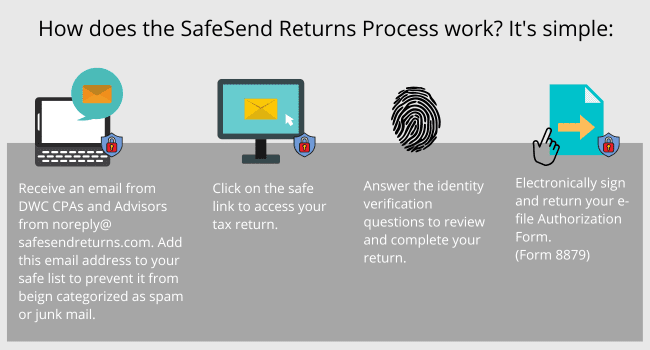

SafeSend Returns Process

Tutorials

Frequently Asked Questions

Individual returns:

Space