Blog

Planning an Exit Strategy for Your Business

Every business owner should have an exit strategy that helps recoup the maximum amount for his or her investment. Understanding the tax implications of a business sale will help you plan for — and, in some cases, reduce — the tax impact. One option is to sell your business to

Potential Exceptions to the IRA Early Withdrawal Penalty Tax

If you’re facing a serious cash shortfall, one possible solution is to take an early withdrawal from your traditional IRA. That means one before you’ve reached age 59½. For this purpose, traditional IRAs include simplified employee pension (SEP-IRA) and SIMPLE-IRA accounts. Here’s what you need to know about the tax

Choosing a Business Entity Type

If you’re planning to start a business or thinking about changing your business entity, you need to determine what will work best for you. Should you operate as a C corporation or a pass-through entity such as a sole-proprietorship, partnership, limited liability company (LLC) or S corporation? There are many issues to

Pitfalls of Payable-On-Death Accounts

Payable-on-death (POD) accounts can provide a quick, simple and inexpensive way to transfer assets outside of probate. They can be used for bank accounts, certificates of deposit and even brokerage accounts. Setting one up is as easy as providing the bank with a signed POD beneficiary designation form. When you

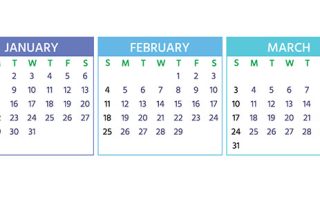

Q1 2024 Key Tax-Related Deadlines for Businesses

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re

What happens if you are subject to a DOL plan audit?

All but the smallest businesses today are generally expected to offer employees “big picture” benefits such as health insurance and a retirement plan. Among the risks of doing so is that many popular plan types must comply with the Employee Retirement Income Security Act (ERISA). That means lots of rules

2024 Inflation-Adjusted Tax Parameters for Small Businesses and Their Owners

The IRS recently announced various inflation-adjusted federal income tax amounts. Here’s a rundown of the amounts that are most likely to affect small businesses and their owners. Rates and Brackets If you run your business as a sole proprietorship or pass-through business entity (LLC, partnership or S corporation), the business’s

2024 Inflation-Adjusted Tax Amounts for Individuals

The IRS recently announced various 2024 inflation-adjusted federal tax amounts that affect individual taxpayers. Most of the federal income tax rate bracket thresholds are about 5.4% higher than for 2023. That means that you can generally have about 5.4% more income next year without owing more to the federal government.

Use QuickBooks for 2024 Budgeting and Forecasting

As year end nears, many businesses and nonprofits are planning for 2024. QuickBooks® provides budget and forecast features to help management make financial predictions, as well as assess “what if” scenarios to help make more-informed business decisions. Here’s how you can use these tools for your year-end financial planning. Budgets

Planning for Net Investment Income Taxes

The 3.8% net investment income tax (NIIT) is an additional tax that applies to some higher-income taxpayers on top of capital gains tax or ordinary income tax. Fortunately, there are strategies you can use to soften the blow of the NIIT. Are you subject to the NIIT? You’re potentially liable