2020 Year-End Tax Planning Highlights for Individuals

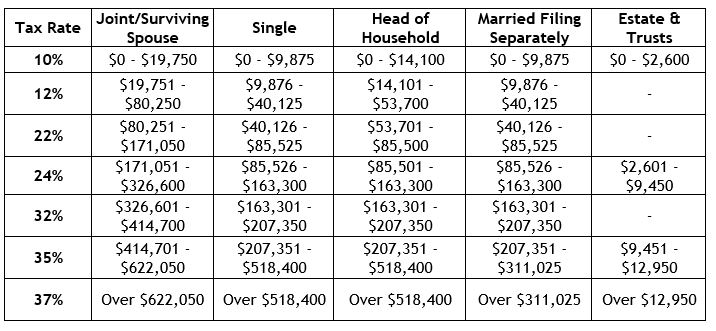

As the year-end approaches, individuals, business owners and family offices should be reviewing their situations to identify any opportunities for reducing, deferring or accelerating tax obligations. Areas that should be looked at in particular include tax reform provisions that remain in play, as well as new opportunities and relief